Home Loan EMI Calculator

₹0

Monthly EMI

₹0

Total Interest

₹0

Total Payment

Home Loan Calculator: Easily calculate your monthly payments and visualize your loan amortization with interactive charts and essential financial metrics.

Discover how home loan calculators simplify mortgage planning by offering accurate monthly payment estimates. Understand the role of loan amount, interest rate, and loan term in shaping financial commitments.

Learn to make informed decisions regarding your mortgage and explore the benefits of using visual tools like loan amortization charts and infographics to enhance your financial literacy in homeownership.

Home Loan Calculator: Mastering Your Monthly Payments

Navigating the journey of homeownership can often seem complex, particularly when it comes to understanding the financial responsibilities involved. A crucial tool in this process is the home loan calculator. Designed to demystify the intricacies of mortgage planning, home loan calculators enable prospective homeowners to estimate their monthly payments accurately.

By inputting key variables such as the loan amount, interest rate, and loan term, individuals can gain a clearer picture of their financial commitments.

The purpose of a home loan calculator extends beyond mere number crunching. It serves as a foundational tool for budget planning, assisting users in aligning their financial capabilities with their homeownership aspirations.

With real estate values fluctuating and interest rates varying, a home loan calculator offers a dynamic method to stay well-informed. This empowers users to make educated decisions, fostering greater financial literacy and reinforcing responsible borrowing habits.

A home loan calculator typically requires users to input three main variables: the principal loan amount, the annual interest rate, and the term of the loan in years.

Additionally, some calculators might include fields for property taxes and homeowners' insurance, further refining the monthly payment estimation. By adjusting these parameters, prospective homeowners can explore various scenarios, enabling them to choose the most suitable mortgage option.

Understanding the utility of a home loan calculator is essential for anyone contemplating taking out a mortgage. The simplicity and accessibility of these tools make them indispensable for both first-time buyers and seasoned homeowners alike.

By providing a realistic view of potential financial obligations, home loan calculators can significantly reduce the uncertainty associated with the mortgage application process, thereby simplifying the path to homeownership.

Understanding Loan Amount

The loan amount is a crucial component of a home loan, representing the total principal borrowed from a lender to purchase a property. This figure plays a pivotal role in determining your monthly payments and overall financial commitment.

Typically, the loan amount is derived from the property's purchase price, less any down payment made. The down payment itself is a percentage of the property's cost, designed to reduce the loan amount required and demonstrate the borrower's financial solidity.

Various factors contribute to establishing the loan amount. Primarily, the property's purchase price is considered, but additional financial elements such as closing costs, home renovation expenses, and other associated fees may also influence the principal. Borrowers must be acutely aware of these cumulative costs to avoid underestimating the total loan amount needed.

Moreover, the size of the loan amount directly affects your monthly mortgage payments. A higher loan amount results in larger monthly installments, reducing financial flexibility.

Conversely, opting for a smaller loan amount translates to more manageable monthly payments, making it vital for borrowers to evaluate their income and existing financial obligations before determining the appropriate loan size. Indeed, the decision must align with both current financial standing and future financial goals.

Another critical aspect is the impact of loan amount on interest rates. Lenders often offer more favorable interest rates for lower loan amounts, as these present lower risks.

This nuance further underscores the importance of precision in calculating the loan amount, factoring in down payments and additional costs. Prospective borrowers should use a home loan calculator to simulate different scenarios, enabling them to visualize and prepare for the financial requirements associated with varying loan amounts.

Ultimately, understanding the loan amount's nuances equips borrowers with the knowledge to make informed decisions, ensuring their mortgage aligns with their financial capabilities and long-term objectives. Proper comprehension and calculation can significantly influence financial stability and homeownership experience.

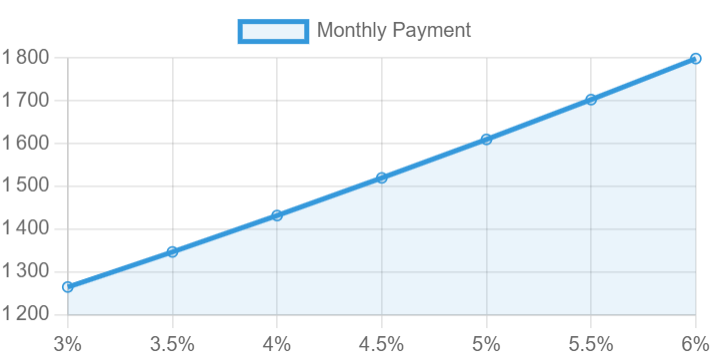

The Role of Interest Rate in Home Loans

Interest rates play a pivotal role in determining the cost of a home loan over time. When you secure a mortgage, the interest rate is the principal component that dictates how much extra you will pay to borrow the funds.

Understanding how these rates are set and what factors influence them can help potential homeowners make informed decisions to manage their monthly payments effectively.

Interest rates are generally set by lenders based on a complex interplay of factors including, but not limited to, the central bank’s policies, inflation forecasts, and broader economic conditions. For individual borrowers, the rate offered will also reflect personal financial health indicators such as credit score, debt-to-income ratio, and overall financial stability.

A higher credit score typically results in a lower interest rate, translating to cheaper monthly payments and less money paid over the life of the loan.

Moreover, it’s crucial to understand the distinction between fixed and variable interest rates. A fixed interest rate remains constant throughout the loan term, offering stability and predictability in monthly payments, albeit often at a slightly higher rate compared to initial variable rates.

Conversely, a variable interest rate is tied to an index or benchmark and can fluctuate based on market conditions. While variable rates may start lower than fixed rates, they pose the risk of upward adjustments, potentially leading to increased payments over time.

Securing a favorable interest rate is paramount to minimizing long-term mortgage costs. A lower rate can significantly reduce total payments, saving the homeowner thousands of dollars over the term of the loan.

Homebuyers should actively seek to improve their credit scores, reduce existing debt, and stay informed about market conditions to potentially secure better terms when locking in an interest rate.

In essence, understanding and navigating interest rates can empower homebuyers to manage their monthly payments effectively and achieve long-term financial benefits. By making strategic decisions related to their mortgage terms, individuals can safeguard their financial well-being while ensuring the affordability of their homes.

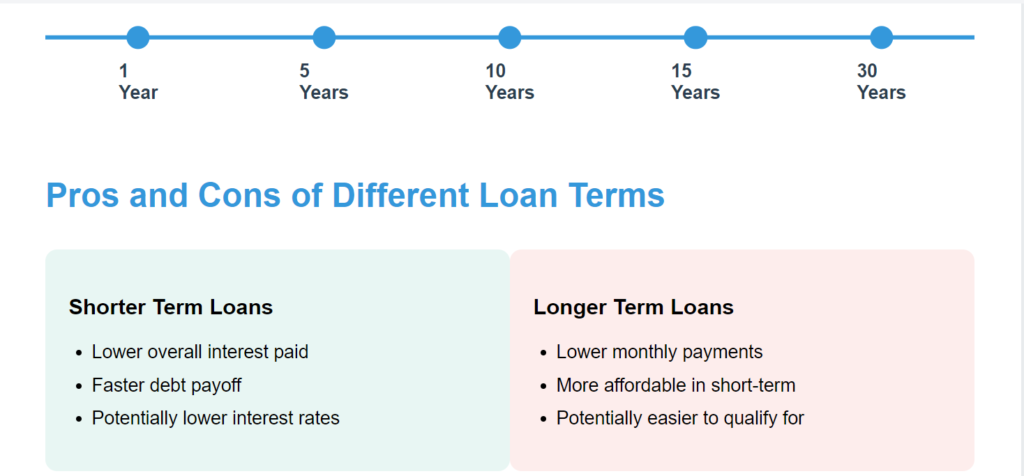

Loan Term: Deciding the Duration

Choosing the duration of your home loan is a significant decision that can deeply impact both your monthly payment and the total interest paid over the life of the loan.

Home loans commonly come in durations of 15, 20, or 30 years, each exhibiting distinct advantages and trade-offs. Understanding these nuances can help tailor a home loan to suit your financial goals and lifestyle.

A 15-year home loan term, for instance, typically comes with higher monthly payments but substantially lower total interest paid.

This shorter term results in a quicker build-up of equity, enabling homeowners to own their property outright in half the time compared to a 30-year loan. Though the monthly financial commitment is steeper, the overall financial health of a borrower can benefit from reduced interest costs and faster equity accumulation.

On the other hand, a 30-year home loan term spreads the repayment over a more extended period, resulting in lower monthly payments.

This increased affordability can make it easier for borrowers to manage their monthly budgets and address other financial priorities. However, the trade-off lies in the higher total interest paid over the lifetime of the loan, which can significantly increase the overall cost of homeownership.

The 20-year home loan term offers a middle ground, balancing higher monthly payments of a 15-year term and the higher total interest of a 30-year term. This option can be attractive for borrowers looking for a compromise between the two extremes, providing fairly manageable monthly payments while also saving on total interest compared to a 30-year term.

Ultimately, the choice of loan term should reflect the borrower’s financial stability, long-term goals, and immediate budget constraints. A shorter loan term may appeal to those who prioritize financial flexibility and long-term savings, whereas a longer term can offer greater ease of monthly cash flow. By evaluating the implications of each loan term, borrowers can make informed decisions that align with their broader financial strategy.

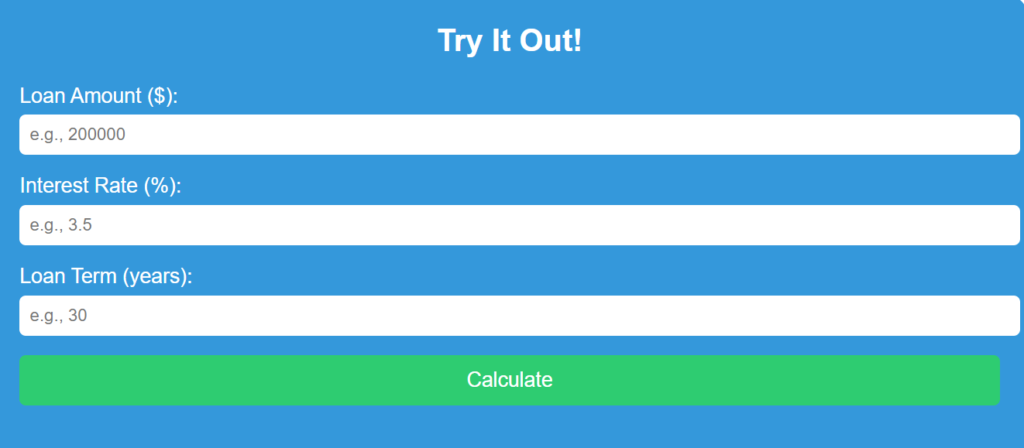

How to Use a Home Loan Calculator

A home loan calculator is an invaluable tool for prospective homeowners, enabling them to estimate their monthly mortgage payments with ease. The process of using a home loan calculator involves a few key steps, each of which will ensure you receive an accurate projection of your financial obligations.

Here’s a comprehensive guide to help you navigate through this essential tool effectively.

First and foremost, you will need to input the loan amount, which is the total amount you plan to borrow. This figure should exclude any down payment and be reflective of the actual funds required to purchase the property. Accuracy here is imperative; even a slight deviation can result in significant variations in your estimated monthly payments.

Next, enter the interest rate. This rate is typically provided by your lender and represents the cost of borrowing the loan amount. Interest rates are expressed as a percentage and can be either fixed or variable.

A fixed-rate remains constant throughout the loan term, whereas a variable rate can change periodically. Ensure you are using the correct rate type as per your loan agreement to achieve an exact estimate.

The final essential input is the loan term, which denotes the duration over which you will repay the loan. Common loan terms include 15, 20, or 30 years.

The length of the term significantly influences the monthly payment; longer terms generally result in lower monthly payments but higher overall interest costs. Conversely, shorter terms lead to higher monthly payments with lower total interest paid over the life of the loan.

Once all the correct data is entered, the home loan calculator will generate an estimated monthly payment. It is important to review these results carefully. Consider the calculated monthly payment in the context of your overall budget to determine its feasibility.

If needed, you can adjust the loan amount, interest rate, or loan term to explore different scenarios and find a payment plan that suits your financial situation.

By meticulously entering accurate data and reviewing the results, you can harness the full potential of a home loan calculator, thus making informed and prudent decisions regarding your mortgage commitments.

Interpreting the Calculation Results

Utilizing a home loan calculator can be a significant step toward grasping the financial commitments associated with a mortgage. Once you input the necessary data, the calculator generates various results that offer a comprehensive snapshot of your loan obligations.

Understanding these metrics is crucial for effective financial planning and ensuring manageable monthly payments.

The primary result you'll encounter is the total monthly payment. This figure represents the cumulative amount you are obligated to pay each month, encompassing both principal and interest. By knowing this monthly payment, you can assess how it fits within your overall budget and determine if the loan terms are feasible for your financial situation.

The next critical component is the principal and interest breakdown. The principal refers to the initial amount borrowed, while the interest is the fee charged by the lender for providing the loan. In the early stages of the loan term, a larger portion of your monthly payment typically goes toward interest, with the principal portion gradually increasing over time.

This breakdown helps you understand how your payments evolve and the rate at which you are building equity in your home.

Another essential metric is the total interest paid over the life of the loan. This figure provides a cumulative sum of all interest payments made from the beginning to the end of the loan term.

Understanding this total can be an eye-opener, revealing the true cost of borrowing and potentially prompting you to explore options for reducing interest payments, such as refinancing or making additional principal payments.

By interpreting these results accurately, you can make informed decisions about your home loan, ensuring that your monthly payments remain manageable. Utilizing a home loan calculator not only provides clarity but also empowers you to navigate the complexities of home financing with confidence and foresight.

Visualizing Loan Amortization with Charts

Loan amortization charts are crucial tools for anyone considering or currently repaying a home loan. By graphically representing the repayment process, these charts provide a clear and concise way to understand how monthly payments are allocated between principal and interest over the life of the loan.

The amortization schedule is a breakdown that shows this distribution month by month, from the first payment to the last.

Initially, a significant portion of each payment is applied towards interest, with the remaining amount reducing the principal balance. As time progresses, the allocation gradually shifts, with more of each payment going towards the principal and less towards interest.

Visualizing this shift through loan amortization charts helps borrowers see how their payments contribute to the eventual payoff of the loan.

The benefits of using visual tools extend beyond understanding the immediate breakdown of each payment. They also offer strategic insights. For instance, borrowers can observe the impact of additional principal payments.

By adding even a small extra amount towards the principal each month, they can see how it accelerates the repayment schedule and reduces the total amount of interest paid over the life of the loan. This kind of visualization aids in making informed decisions about managing the loan effectively.

Moreover, these charts can be pivotal during the early stages of mortgage planning. Potential homeowners can assess different loan scenarios, comparing various interest rates, loan terms, and down payments to select the most suitable option for their financial situations. The clarity provided by these visual representations makes complex financial data easier to interpret, enabling borrowers to plan and budget accurately.

In conclusion, loan amortization charts are more than just informative graphics; they are powerful tools that foster a deeper understanding of the repayment process. By regularly reviewing these charts, borrowers can stay on top of their loan status, make strategy adjustments, and ultimately, gain confidence in their financial decision-making.

Infographics: Key Financial Metrics at a Glance

In the realm of home financing, comprehending the myriad of financial metrics associated with home loans is crucial but can often be overwhelming.

That's where infographics come into play, serving as a valuable tool to encapsulate and distill essential financial data into easily digestible visuals. These graphical representations not only simplify complex information but also facilitate informed decision-making by presenting key metrics in a clear and concise manner.

One of the most vital metrics displayed within a home loan infographic is the loan-to-value (LTV) ratio. This metric illustrates the relationship between the loan amount and the appraised value of the property, helping borrowers understand the extent of equity they hold in the property. A higher LTV ratio signifies greater risk and may affect loan terms and interest rates.

Total interest paid over the life of the loan is another crucial metric that infographics can effectively highlight. By visualizing this cost, borrowers can grasp the long-term financial impact of different loan options.

This knowledge empowers them to make calculated decisions about their financing strategies, such as opting for a shorter loan term or considering additional payments to reduce overall interest expenses.

Monthly budget impact is equally significant and can be succinctly illustrated within an infographic. This metric reveals how monthly loan payments will affect an individual's or family's overall budget.

By showing the proportion of income allocated to the mortgage, additional expenses, and savings, borrowers can better assess their financial readiness and ensure their monthly commitments remain sustainable.

In evaluating different loan options, infographics provide a swift and intuitive comparison by juxtaposing key metrics side by side. When reviewing multiple loan offers, borrowers can utilize these visual tools to quickly identify the most cost-effective and manageable option.

Look for infographics that present data such as interest rates, LTV ratios, and total interest paid to ensure an all-encompassing view of each potential loan.

Ultimately, the use of infographics in summarizing key financial metrics for home loans empowers borrowers to make well-informed decisions with confidence and clarity. By leveraging these visual tools, individuals can navigate the complexities of home financing with greater ease and precision.

In conclusion, utilizing a professional home loan calculator is an invaluable step for prospective homeowners seeking to understand their financial commitments. By inputting the loan amount, interest rate, and term length, users can not only calculate their monthly payments but also visualize the loan amortization through a comprehensive chart.

This tool enhances financial literacy by presenting key metrics in an easy-to-understand infographic format, enabling borrowers to make informed decisions. With these insights, individuals can better plan their budgets and anticipate future expenses associated with homeownership. Take control of your financial journey today by exploring our home loan calculator and unlocking the door to your dream home!

Here are some calculators maybe you need in your life

Age Calculator By Minute: Discover your age in terms of years, months, weeks, days, hours, minutes, given a date of birth. Start now

BMI Calculator: Discover your body mass index for a healthier you. Track your progress & reach your fitness goals effortlessly.

Home Loan Calculator: Calculate your monthly payments and visualize your loan amortization with interactive charts and essential financial metrics.